Zyn’s Regulatory Roadblock: A Flavor Ban Shakes Up the Nicotine Pouch Market

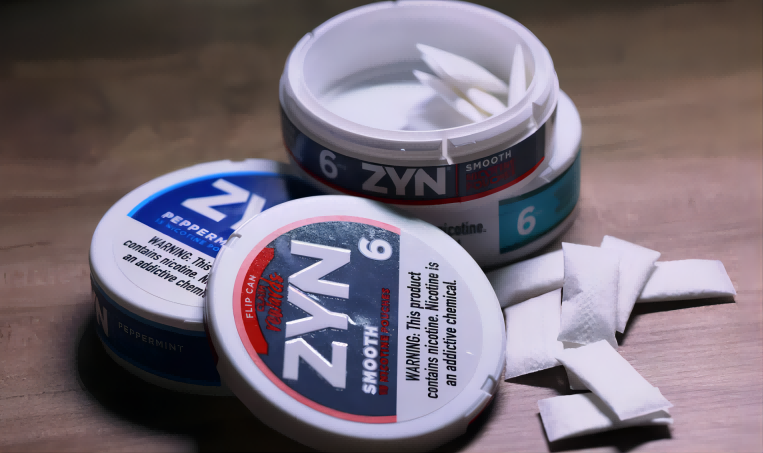

Philip Morris International (PMI) found itself at a crossroads in 2023, having recently acquired Swedish Match and its popular nicotine pouch brand, Zyn. Amidst soaring demand and ambitious growth projections, the company faced an unexpected hurdle: a sudden suspension of Zyn’s nationwide online sales through Zyn.com. A subpoena from Washington, D.C.’s Attorney General, Karl Racine, who launched an investigation into potential non-compliance with the city’s ban on flavored tobacco products triggered this abrupt pause. The investigation, spurred by concerns raised by Senate Majority Leader Chuck Schumer regarding Zyn’s marketing tactics and potential health effects, brought to light the complex and evolving regulatory landscape surrounding nicotine pouches. While PMI scrambled to address the situation, the incident highlighted the challenges faced by the entire nicotine pouch industry as it grapples with increasing scrutiny and shifting regulations aimed at curbing youth appeal. Regulatory Landscape: A Closer Look at D.C.’s Flavor Ban and Its Ripple Effects Washington, D.C.’s ban on flavored tobacco products, implemented in 2022, aims to curb the appeal of these products to young people by prohibiting the sale of any tobacco product with a characterizing flavor other than tobacco within city limits. This sweeping ban encompasses not only Zyn but also an array of flavored cigarettes, e-cigarettes, and other tobacco products, forcing companies to re-evaluate their market strategies. The ban’s impact is not limited to the D.C. market. It has sent ripples throughout the nicotine pouch industry, prompting companies to scrutinize their product offerings and marketing practices. Some companies have proactively reformulated their products to remove characterizing flavors, while others are exploring unflavored or traditional tobacco-flavored alternatives to stay compliant. However, the ban has also sparked debate and opposition. The Vapor Technology Association (VTA) has been vocal in its criticism, arguing that such bans deprive adult smokers of less harmful alternatives and hinder smoking cessation efforts. The VTA emphasizes the need for a diverse range of non-combustible nicotine products to cater to adult consumers seeking safer choices. Meanwhile, the FDA has taken enforcement actions against retailers selling Zyn products to underage consumers, issuing warning letters and civil money penalty complaints. This heightened regulatory scrutiny underscores the government’s commitment to protecting young people from the potential harms of nicotine addiction. As the dust settles around the D.C. ban, its effects will reverberate throughout the nicotine pouch industry for years to come. Companies will need to continue adapting to the evolving regulatory landscape, balancing compliance with consumer demand and product innovation. The Nicotine Pouch Paradox: Soaring Demand and Regulatory Headwinds The nicotine pouch market presents a fascinating paradox: consumer demand is skyrocketing, yet regulatory pressures are intensifying. Euromonitor’s research reveals a growing acceptance of smoke-free alternatives, especially in regions with stringent anti-smoking policies. This trend, coupled with the convenience and discreetness of nicotine pouches, has fueled their popularity, leading to a surge in sales in recent years. PMI’s Zyn, in particular, has experienced remarkable growth, with shipments increasing by 62% in 2023. This success, however, has been tempered by supply chain constraints and regulatory challenges. The D.C. ban on flavored tobacco products, along with ongoing lawsuits concerning Zyn’s nicotine content and marketing practices, has created a complex and unpredictable environment for the company and the industry. Despite these hurdles, the overall market outlook for nicotine pouches remains positive. The demand for smoke-free alternatives continues to rise, presenting significant opportunities for companies that can navigate the regulatory landscape and innovate to meet evolving consumer preferences. This has led to a dynamic market where established players like PMI are vying for market share alongside newer entrants, all seeking to capitalize on the growing demand for less harmful nicotine delivery systems. However, the regulatory environment remains a wild card. As governments wrestle with the potential health risks and youth appeal of nicotine pouches, companies must remain vigilant and adaptable. The ability to expect and respond to regulatory changes will be crucial for sustained success in this burgeoning market. Industry Adaptation: How Nicotine Pouch Companies are Navigating a Changing Landscape Faced with the turbulent regulatory environment and evolving consumer preferences, nicotine pouch companies are adapting and innovating to maintain their market presence and ensure future growth. Product Diversification and Innovation: Marketing and Consumer Education: Supply Chain Optimization: Collaboration with Regulators: The future of nicotine pouches is being written as we speak, shaped by a dynamic interplay of consumer preferences, regulatory hurdles, and innovative solutions. Companies like PMI are at the forefront of this evolution, striving to adapt, innovate, and ensure a sustainable future for their products. While the road ahead may be uncertain, the nicotine pouch industry’s ability to respond to these challenges will determine its long-term success in an ever-changing market. PMI’s Response: Adapting to the Headwinds Faced with these challenges, Philip Morris International (PMI) has showed a proactive and adaptable approach. Recognizing the need to adhere to local regulations, the company swiftly suspended online sales of Zyn through its website, Zyn.com, following the D.C. subpoena. This decisive action shows PMI’s commitment to compliance and responsible business practices. The company is thoroughly reviewing its sales and supply chain arrangements to ensure full adherence to all applicable laws and regulations. While this temporary suspension may impact short-term sales, PMI views it as a necessary step in maintaining its reputation as a responsible corporate citizen. Beyond addressing the immediate regulatory challenge, PMI is actively investing in expanding its production capacity to meet the surging demand for Zyn. The company recognizes that supply chain disruptions can lead to shortages and frustrate consumers and is committed to mitigating these issues through increased production and optimized logistics. PMI is also confronting several lawsuits related to Zyn’s nicotine content and marketing practices. The company maintains that its products comply with all applicable laws and regulations and is actively defending itself in these legal battles. Additionally, PMI is engaging with regulators to address any concerns and ensure that its products meet evolving standards. Through these actions, PMI demonstrates its commitment to navigating the complex regulatory landscape while maintaining its focus on meeting